Jeffrey Varner holds a Bachelor of Science degree (Chemistry), a Masters and a Ph.D. degree in Chemical Engineering, from Purdue University. Prof. Varner’s graduate thesis work at Purdue was done under the direction of Prof. D. Ramkrishna in the area of modeling and analysis of metabolic networks. Following Purdue, Prof. Varner was a postdoctoral researcher in the Department of Biology at the ETH-Zurich where he studied signal transduction mechanisms involved in cell-death under Prof. Jay Bailey. After the ETH, Prof. Varner was a Scientist in the Oncology business unit of Genencor International Inc, Palo Alto, CA. While at Genencor, Prof. Varner was involved in the discovery of novel targets in human cancers, and was a project team member for preclinical, phase-I and II studies of protein therapeutics for the treatment of colorectal cancer and Chronic Lymphocytic Leukemia (CLL). Prof. Varner left Genencor at the end of 2005 to join the faculty of the Chemical and Biomolecular Engineering department at Cornell University. At Cornell, the Varner lab is developing physiochemical modeling tools to rationally reprogram human signal transduction architectures.

Quantitative

ModelingCornell Certificate Program

Overview and Courses

In today’s evolving financial landscape, quantitative methods have become essential for analyzing complex financial data, modeling risk and reward, and optimizing investment strategies.

In this certificate program, you will gain a comprehensive understanding of quantitative finance principles and techniques using the Julia programming language, a valuable tool for quantitative finance professionals and researchers. Throughout the program, you will explore topics such as modeling and analysis of standard investment instruments (e.g., fixed income, equity, and derivatives), portfolio optimization, risk management, and computational finance decision making through practical, hands-on learning. By the end of the program, you will have the opportunity to apply your skills to build your own trading bot. Whether you're a seasoned finance professional looking to improve your quantitative skills or an engineer delving into finance, this program will give you a strong foundation in using Julia to apply computational methods and model financial outcomes.

This certificate program requires students to have an understanding of high school-level calculus; basic understanding of data analytics, modeling, and simulation; and be comfortable with typical programming idioms in common languages like MATLAB or Python.

The courses in this certificate program are required to be completed in the order that they appear.

Course list

United States Marketable Treasury Securities are widely considered one of the safest global investments. How can you better understand, apply, and model these securities?

In this course, you will be introduced to zero-coupon and multiple-coupon Treasury securities. You will compute the price of these investments using the Julia programming language and discover what factors influence the price. After completing this course, you will understand the different types of Treasury securities, how to price them, the factors that influence their price, and how to model their outcomes, setting you up with hands-on experience in foundational quantitative skills.

- Feb 26, 2025

- Apr 23, 2025

- Jun 18, 2025

- Aug 13, 2025

- Oct 8, 2025

- Dec 3, 2025

When people think about investing, they typically consider stocks and the stock market. Unlike Treasury securities, investing in equities like stocks involves purchasing shares in a publicly traded company on an exchange, which comes with significant risks due to share price fluctuations. Predicting exact future share prices is likely an unsolvable problem, but using the power of modeling, you can predict a range of possible future equity share price values.

In this course, you will discover how to use tools in the Julia programming language to simulate and analyze equity share price distributions. You will explore different approaches, from approximating future prices using discrete lattice models to using continuous stochastic modeling to simulate the prices over time for individual stocks and groups of stocks. By the end of the course, you will be able to predict future share price distributions, understand the statistical properties of these distributions, and evaluate the various methods for modeling share prices.

You are required to have completed the following course or have equivalent experience before taking this course:

- Quantitative Modeling of Fixed Income Debt Securities

- Mar 12, 2025

- May 7, 2025

- Jul 2, 2025

- Aug 27, 2025

- Oct 22, 2025

- Dec 17, 2025

Equity derivatives are one of the most exciting and fastest-growing investment categories. It's important to note, however, that these instruments are considerably more complicated than equity and come with unique risks.

In this course, you will examine options and use the Julia programming language to calculate the payoff and profit of these investment products at expiration. Along the way, you will get hands-on experience with simulating options chains and computing profit diagrams. By the end of the course, you will be able to analyze the performance of individual contracts, understand the different styles and types of contracts, and explore combinations of contracts that can result in profitable trades regardless of whether the underlying equity asset price goes up, down, or stays the same.

You are required to have completed the following courses or have equivalent experience before taking this course:

- Quantitative Modeling of Fixed Income Debt Securities

- Equity Asset Pricing Using Stochastic Models

- Mar 26, 2025

- May 21, 2025

- Jul 16, 2025

- Sep 10, 2025

- Nov 5, 2025

- Dec 31, 2025

Equity derivatives are one of the most exciting and fastest-growing investment categories. Yet these instruments are considerably more complicated than equity and come with unique risks.

In this course, you will examine option contract pricing. You will gain hands-on experience with modeling option contract prices based on market and contract parameters, the impact of changing conditions on contract prices (known as the Greeks), and how options contracts can be combined with equity to create unique investment strategies. By the end of the course, you will be able to analyze the performance of contracts over time and under different market conditions before expiration and prepare strategies to use contracts to hedge against various types of market risks.

You are required to have completed the following courses or have equivalent experience before taking this course:

- Quantitative Modeling of Fixed Income Debt Securities

- Equity Asset Pricing Using Stochastic Models

- Analysis of Equity Derivatives at Expiration

- Apr 9, 2025

- Jun 4, 2025

- Jul 30, 2025

- Sep 24, 2025

- Nov 19, 2025

Portfolio allocation is a continuous challenge: Investors must find the right balance between seeking higher returns and managing increased risk. How can you use quantitative modeling to help optimize your portfolio?

In this course, you will delve into data-driven and model-based approaches to portfolio allocation using the Julia programming language. You will discover various methods to estimate the required components of the allocation problem from data or by using simple models. You will then determine how to evaluate portfolio performance and examine the role of diversification in portfolio performance. Finally, you will explore utility maximization, risk aversion, and behavioral finance to help you better understand portfolio allocation choices. By the end of the course, you will be able to develop optimized portfolios that consist of combinations of both more risky assets and risk-free ones to balance risk and reward.

You are required to have completed the following courses or have equivalent experience before taking this course:

- Quantitative Modeling of Fixed Income Debt Securities

- Equity Asset Pricing Using Stochastic Models

- Analysis of Equity Derivatives at Expiration

- Analysis of Equity Derivatives Before Expiration

- Apr 23, 2025

- Jun 18, 2025

- Aug 13, 2025

- Oct 8, 2025

- Dec 3, 2025

Machine learning and artificial intelligence are revolutionizing many fields, including quantitative finance and financial decision making. These technologies offer the possibility of developing advanced approaches to model market behavior and predict optimal trade decisions using various investment tools.

In this course, you will discover how to use the Julia programming language for quantitative financial decision making. You will be introduced to tools like Markov models, Markov decision processes, reinforcement learning, and Q-learning. To apply this knowledge, you will get firsthand experience with the process of building a trading bot. By the end of the course, you will be able to model and analyze investment decision making and develop automated trading systems using these tools.

You are required to have completed the following courses or have equivalent experience before taking this course:

- Quantitative Modeling of Fixed Income Debt Securities

- Equity Asset Pricing Using Stochastic Models

- Analysis of Equity Derivatives at Expiration

- Analysis of Equity Derivatives Before Expiration

- Optimizing Portfolio Allocation

- May 7, 2025

- Jul 2, 2025

- Aug 27, 2025

- Oct 22, 2025

- Dec 17, 2025

How It Works

- View slide #1

- View slide #2

- View slide #3

- View slide #4

- View slide #5

- View slide #6

- View slide #7

- View slide #8

Faculty Author

Key Course Takeaways

- Compute allocations for a portfolio of equities

- Compute the profit and breakeven for European options contracts

- Simulate the options chain for American call and put options

- Compute the probability of profit for a single or composite options contract

- Use dynamic delta hedging to compensate for share price fluctuations

- Construct low and high correlation portfolios of risky assets

- Evaluate the performance of single index models

- Model U.S. Treasury coupon notes and bonds

- Build a trading bot

Download a Brochure

Not ready to enroll but want to learn more? Download the certificate brochure to review program details.

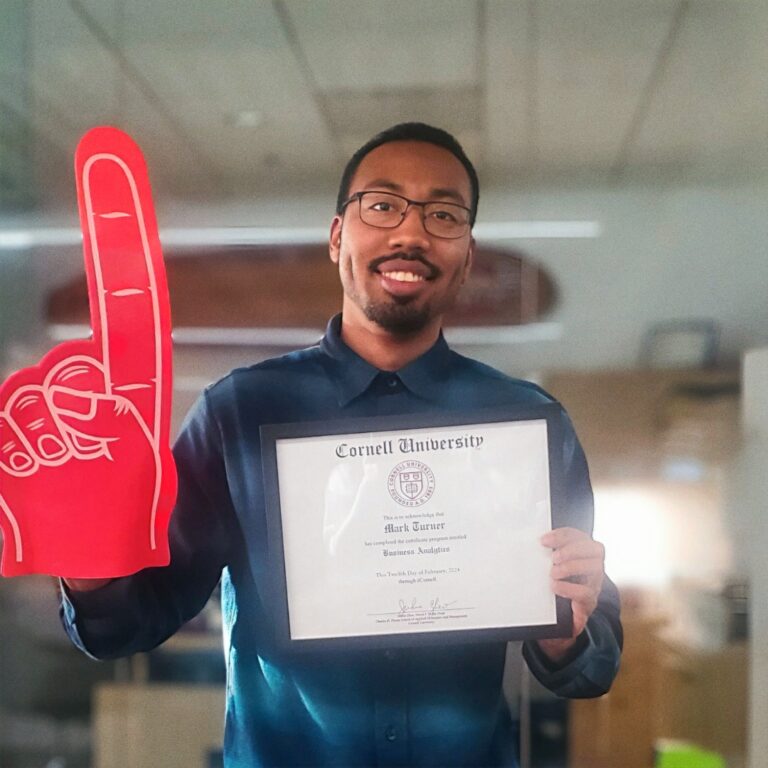

What You'll Earn

- Quantitative Modeling Certificate from Cornell’s College of Engineering

- 96 Professional Development Hours (9.6 CEUs)

Watch the Video

Who Should Enroll

- Quantitative analysts

- Finance professionals looking to upskill in data modeling

- Engineers looking to transition into finance

- Research scientists

- Computer scientists

- Personal investors

Explore Related Programs

Request Information Now by completing the form below.

Quantitative Modeling

| Select Payment Method | Cost |

|---|---|

| $3,750 | |